Zelle® is a fast, convenient way to send money directly from your bank account to friends, family, and businesses. But because transfers happen instantly and cannot be reversed, scammers often target Zelle® users. Knowing the warning signs can help you keep your money safe.

How to Stay Safe

Only Send Money to People You Know – Zelle® is designed for sending money to friends, family, businesses or trusted contacts. Avoid using it for:

- Online purchases from strangers

- Marketplace transactions

- Services from unknown providers

Double Check Recipient Info – Before sending, verify:

- Recipient’s name

- Phone number or email address

Be Wary of Urgency or Pressure – Scammers often create a false sense of urgency. Common red flags:

- “Act now or lose the deal”

- “Your account is compromised—send money to secure it”

Don’t Share Verification Codes – Never give out:

- One-time passcodes

- Bank login credentials

- Personal information over the phone or text

Watch for Fake Zelle®Support – Zelle® will never call, text, or email you to request money or account access. If someone claims to be from Zelle® and asks for money, it’s a scam.

Use Strong Account Security

- Enable multifactor authentication (MFA)

- Use strong, unique passwords

- Monitor your bank account regularly

Report a Scam or Suspicious Activity Immediately

- Stop the transaction immediately, if possible.

- Contact us right away at 203.729.4442.

- Report scams to Zelle’s official site and the Federal Trade Commission or call 1.877.FTC.HELP (382.4357).

Common Zelle® Scams to Avoid

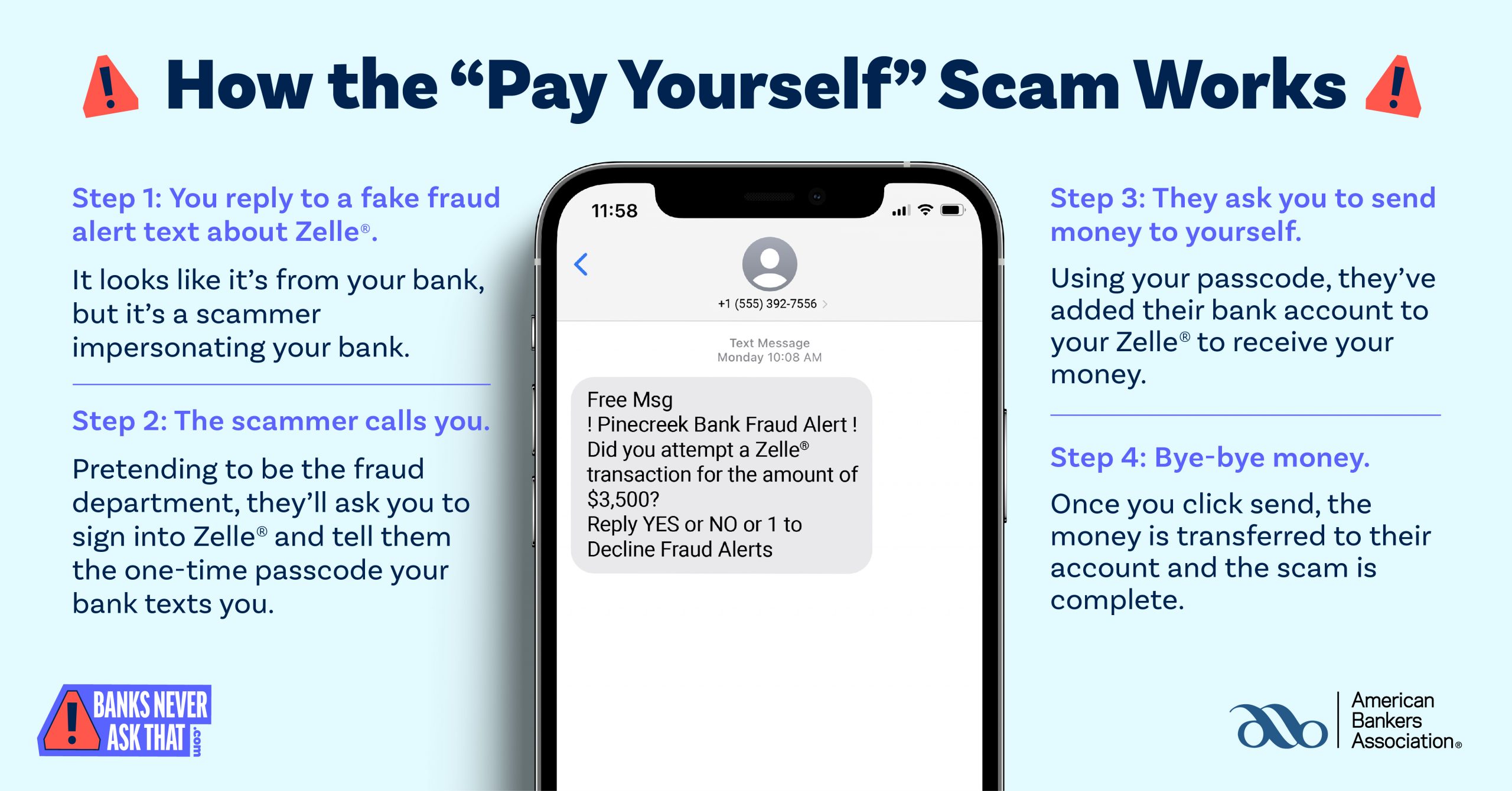

Pay Yourself Scams

Scammers imitate a bank representative and trick you into sending money to their own account by telling you to send it to yourself to “secure” it from fraud. The scammer often starts with a fake, urgent text message about fraudulent activity, and then uses phone calls and social engineering to get you to authorize a transfer to an account they control, not one of your own.

Impersonation Scams

Fraudsters pose as friends, family, or trusted organizations like Ion Bank. They claim there’s an urgent need and request money via Zelle®. Always verify the person or institution using your own contact information—not the number that contacted you.

Refund Request Scams

Scammers send fake payment notifications and ask you to “refund” an accidental payment. The original payment never happened. Always check your Zelle® history and account balance before issuing refunds.

Romance Scams

Fraudsters create fake online identities to build emotional connections and then request money via Zelle®. Be cautious of romantic interests asking for financial help.

Phishing Scams

Criminals send emails or texts pretending to be from a bank or Zelle®, asking you to click links or share sensitive info. Never share login credentials or click suspicious links.

Facebook Marketplace Scam

Scammers list fake items online and request Zelle® payments upfront. Watch for red flags like new accounts with few friends. Verify sellers before sending money.

Fake Invoice Scam

Fraudsters send invoices for goods or services you didn’t purchase, pressuring quick payment via Zelle®. Always confirm invoice details and recipient identity.

Job Opportunity Scam

Scammers offer fake jobs and ask for payment for training or equipment via Zelle®. Legitimate employers never request upfront payments.

Rental Scam

Fraudsters advertise fake rentals and request deposits via Zelle®. Verify the property and landlord before paying. Legitimate rentals involve formal contracts.

Tech Support Scam

Criminals pose as tech support, claiming account issues and requesting remote access or Zelle® payments. Banks will never ask for remote access.

Lottery or Prize Scam

Scammers claim you’ve won a prize but must pay fees via Zelle®. Real lotteries never require upfront payments beyond ticket purchase.

Investment Scam

Fraudsters promise high returns and request Zelle® payments. Avoid unsolicited investment offers, especially those guaranteeing unrealistic profits.